HOMEOWNERS have been left stunned after being unexpectedly slapped with a $16,000 bill just days before Christmas.

Locals in a Rogers, Minnesota neighborhood – located around 25 miles from Minneapolis – claimed the charge was for home repairs they didn’t think they owed.

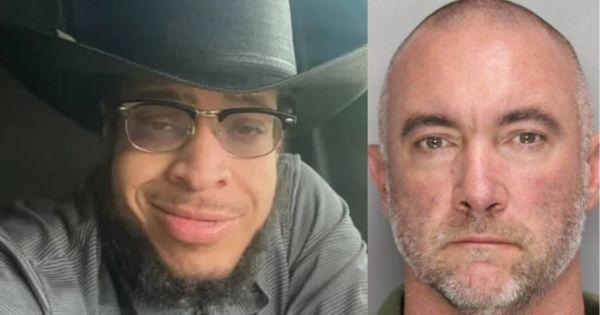

Homeowners in a Minnesota neighborhood say they’ve been hit with hefty bills over supposed roof damageCredit: KMSP

Caitlin Dahlgren said she was hit with a $16,000 billCredit: KMSP

They received notice of the charges via mail and also claimed that bosses of the homeowner’s association threatened them with further penalties if they didn’t comply.

Caitlin Dahlgren, who lives in the Dutch Knolls neighborhood, was reportedly told she needed to pay $16,000, according to Fox affiliate KMSP-TV.

She claimed the bill was over a hailstorm that hit the community in July.

Meanwhile, Bridget Newman said officials have looked at her roof and determined that it didn’t need replacing.

“Our roofs were just replaced two years ago,” she said.

Newman has been left fearing for what might unfold if she doesn’t pay the fine.

“If we don’t pay it, we’ve been told we’ll be getting fees, fined, and they could potentially put a lien against our home if we don’t pay it,” she claimed.

Newman wants officials to provide more clarity and measures for homeowners to be rolled out.

“There needs to be more regulations from higher legislature,” she said.

Officials at Sharper Management, the company that manages the HOA, told KMSP-TV that homeowners should send the bill to their insurance provider.

Homeowners are likely to have an insurance policy known as a HO6, which protects against damage from events such as storms.

The policy also protects homeowners from losses stemming from theft incidents.

However, HO6 property insurance doesn’t cover losses suffered in floods and earthquakes.

Nor does the insurance policy cover damage from nuclear hazards or standard wear and tear.

Experts at the NJM insurance company have shared tips for homeowners when it comes to filing a claim.

They should contact their insurance company before trying to protect their home from any further damage.

They should also prepare a document that determines the damage caused.

The U.S. Sun has approached Sharper Management for further comment.

It’s not just locals in Rogers, Minnesota, that have been hit with hefty bills.

Patricia Aldridge, who lives in Houston, claimed her homeowner’s association passed the buck when it came to repairing her fence after it was damaged in a hurricane.

She claimed that organization bosses told her that it was her responsibility to maintain it.

The U.S. Sun also reported how one woman was evicted from her home and forced to live in her car – just weeks before the holidays.