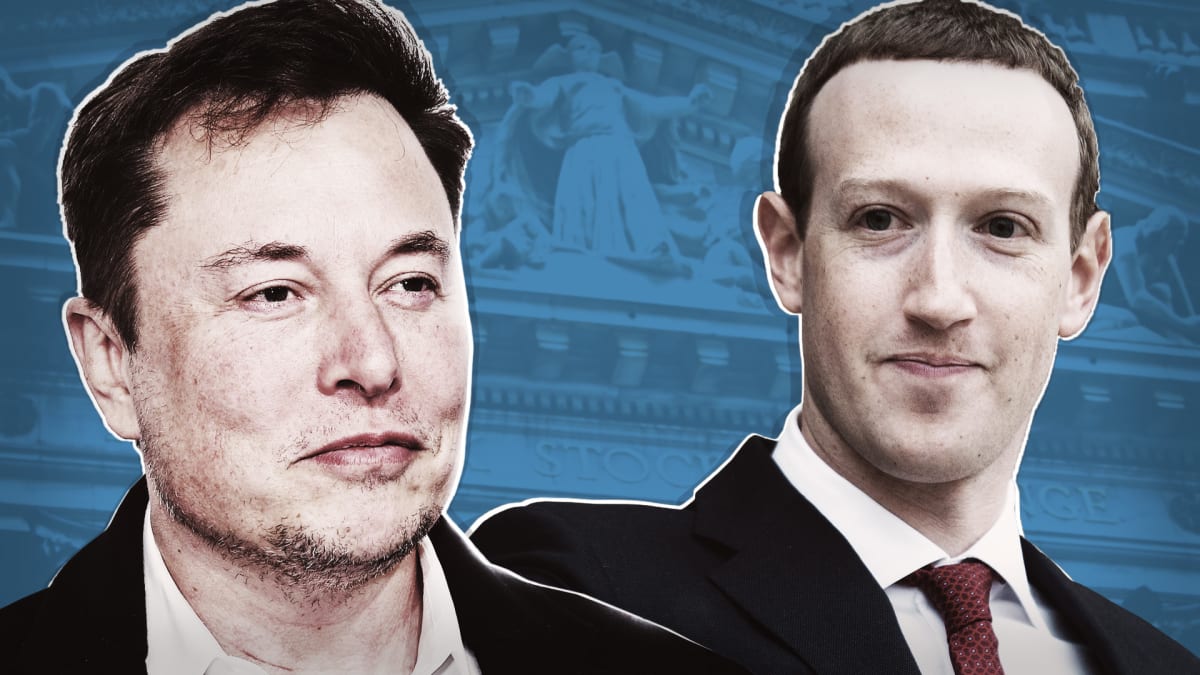

Even the richest people in the world like Elon Musk or Mark Zuckerberg choose to mortgage their homes to borrow money from banks.

Many people think that once they become billionaires, they will buy anything they want with cash, especially a basic need like housing. However, even the richest people in the world like Elon Musk or Mark Zuckerberg choose to mortgage their houses to borrow money from banks.

Why? It really all comes down to some very smart money management.

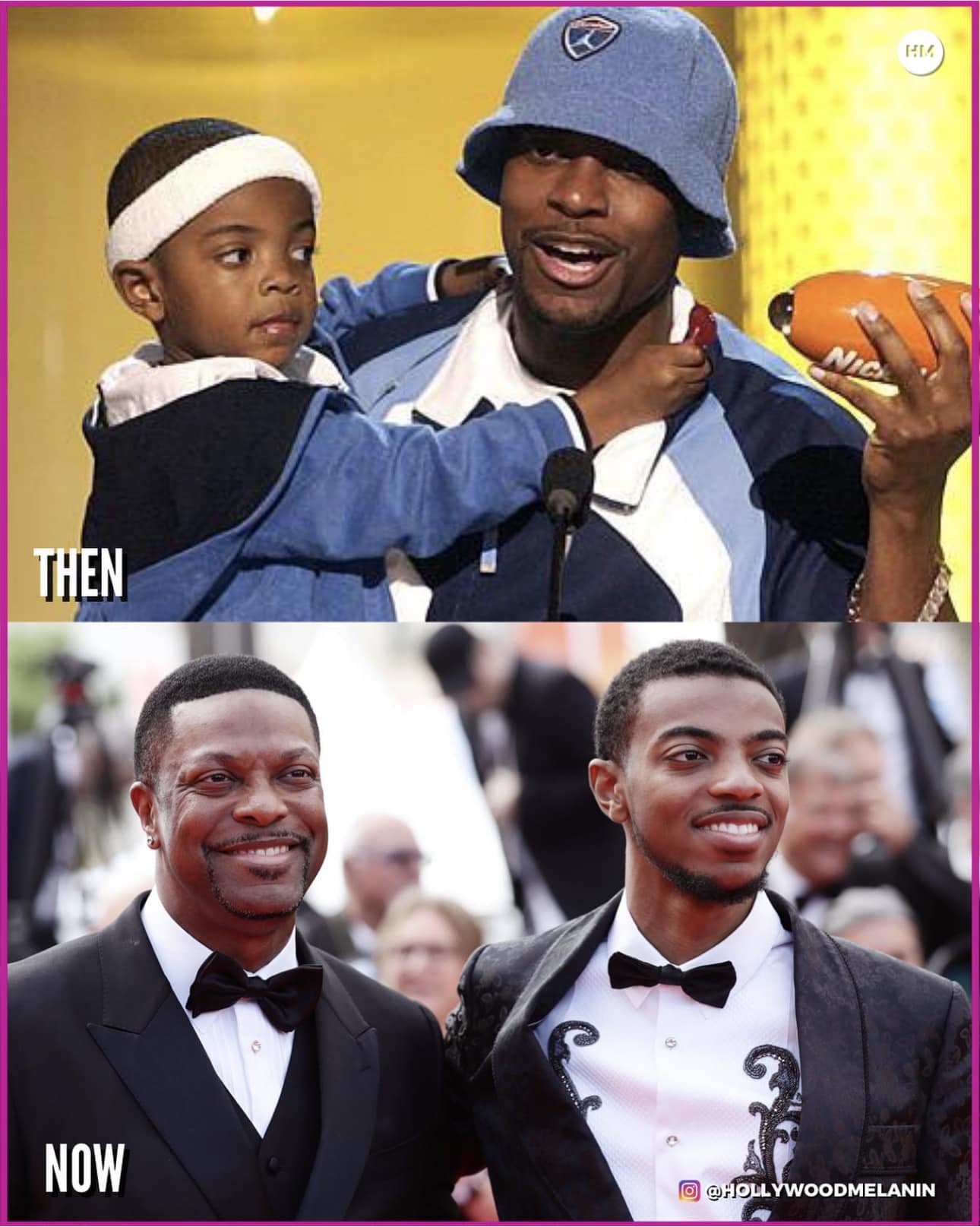

Billionaire Mark Zuckerberg

First, a mortgage helps them keep cash on hand. While cash flow isn’t an issue for people like Musk, it’s still a useful tool. Homes are an “illiquid” asset, and unlike stocks that can be sold immediately, selling a home takes time.

Rather than pouring millions into fixed assets like homes, the ultra-wealthy often prefer to keep cash easily accessible for new investments or potential business opportunities. They can pay their mortgage while still having liquid assets available for other productive purposes.

As Matt Wilson, a financial planner , puts it: “A mortgage gives the wealthy more flexibility in managing their money. They can take advantage of other investment opportunities without having to tie up a large sum of money in one place.”

In addition, according to financial experts, there is another benefit to a mortgage: tax deductions. In the United States, mortgage interest is tax deductible for loans up to $ 750,000 . This helps billionaires still benefit from tax breaks, even if it is a small amount for them.

Billionaire Elon Musk

Another reason to choose a mortgage is investment returns. Currently, the average mortgage interest rate hovers around 6.2%. However, according to statistics, the stock market typically provides an average annual return of about 10%. Even if the actual return is only about 7%, this is still more than the cost of a mortgage.

Think of it this way: instead of spending $500,000 on a house right away, you could take out a mortgage, invest that money in stocks, and maybe earn an 8% return. In the long run, you’ll have more money. That’s wealth optimization.

“Why pay off your mortgage when you can invest that money and earn a higher return? It’s all about making your money work harder,” explains financial expert Sarah Newman.