A WOMAN was blocked from cashing in her tax refund due to a typo by the Internal Revenue Service – and they wouldn’t help for months.

Myrna Hoffman’s daughter got caught up in a year-long battle with the IRS over $11,000 her mom was due from her 2023 taxes.

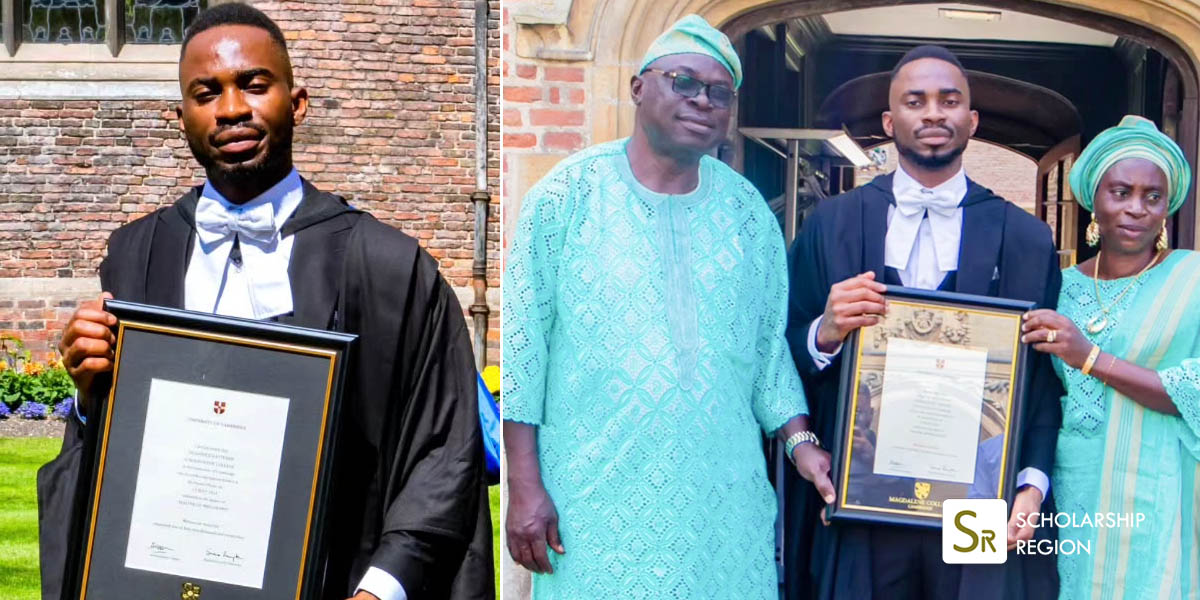

Myrna Hoffman and her daughter, Debra, who ran into a problem with the IRSCredit: WABC

The $11,000 check was voided because of the US Treasury’s typoCredit: WABC

The US Treasury’s check had a percent sign and Myrna’s first name, but no last nameCredit: WABC

Last tax season, Debra Hoffman set out to cash a tax refund check for her mom after it arrived from the US Treasury, she told New York City ABC affiliate WABC-TV.

Her mom worked hard for her cash and started her career at a clothing boutique in the 1950s.

Now, 92-year-old Myrna suffers from dementia, so Debra was helping her mom cash in her 2023 refund check.

However, there was a major problem with Myrna’s funds.

The check had the percent sign and Myrna’s first name on it, but no last name, Debra told the outlet.

Debra, who lives on Long Island, New York, couldn’t cash the check for her mom because of the typo.

To make matters worse, the IRS wasn’t very responsive about its mistake.

“When I finally did get in touch with someone, they told me it would be 30 days, and then you’ll get a new check, and then that didn’t happen,” Debra said.

The massive check was left in limbo for months.

Debra was even more stressed about the money after her mom got sick.

She said she couldn’t believe the US Treasury would make such a major mistake.

After Debra reached out to WABC-TV to share her story, the outlet contacted the IRS.

Thankfully, the agency resent the check.

After months of fighting, a typo-free check was finally made out to Myrna.

While Myrna and Debra faced a tax nightmare, most Americans will hopefully have an easier path when filing their returns this year, despite President Donald Trump firing thousands of IRS workers.

The massive cuts are expected to cause serious delays in returns during peak filing season.

There are still a few weeks left to file, as Americans have until April 15, 2025, to get their federal returns.

However, there are three ways taxpayers can get an extension.

First, Americans can request an extension to file instead by October 15, according to the IRS website.

Extension requests have to be submitted before the original deadline of April 15 by using Form 4868.

You can also extend your deadline through an IRS e-filing partner or a local tax professional.

Myrna Hoffman, whose check sat in limbo for months after a typo stopped her from cashing it inCredit: WABC

Debra celebrating with WABC-TV after the IRS finally recut her mom’s checkCredit: WABC

Debra speaking to WABC-TV about the IRS’ mistakeCredit: WABC